How to Create a Demand Generation Strategy from Scratch

So, the job was mine.

They were going to announce my promotion at our next big all-hands meeting, which happened to be about a week away, and I felt giddy.

All of the work I had done digging into the data, preparing graphs and forecasts, and writing out analyses of why things needed to change and how I could make it happen had paid off.

I let the emotions of excitement, accomplishment, and let’s be real, a tinge of anxiety, wash over me. But after the initial moment of self-satisfaction passed, I knew it was time to get my head back in the game.

There was a lot to do and not a lot of time to get it done.

During the phase where I had to make a case for creating the Demand Generation department, I spent a lot of time trying to understand the SDR program’s mechanics and why it might be failing.

But these were mostly surface-level attempts. Now was the time to take the full plunge.

This thought was unsettling because I don’t do well with ambiguity. Before I let myself get too overwhelmed by the uncertainty and lack of control, I identified five key areas to focus on.

Those specific areas were:

- People

- Process

- Goals

- Benchmarks

- Budget

I figured that if I could understand the main challenges and potential paths to follow for each of these core concepts, I would stay afloat.

Not only that, having this information was a necessary starting point for taking the first steps toward execution.

But before you can create your map from point A to point B, you need to know where point A is located.

Pre-Launch: Find the Starting Point

A map is useless if you don’t know where you are.

But usually, there are some identifiable landmarks nearby to give you a hint.

I knew I had a considerable knowledge deficit concerning building and managing a sales team, so my first move was purchasing Trish Bertuzzi’s “Sales Development Playbook” and reading it cover to cover while jotting down copious notes.

During this process, I realized how many questions I didn’t know I needed to ask and how many of them I didn’t know the answers to.

This realization was integral in identifying what I needed to define in my strategy – certain things like whether our team would focus on providing our AEs with introductory meetings or qualified opportunities and how we would handle inbound versus outbound leads.

All of the specific items that needed to be considered to build a functional program were unclear, but they were coming to light.

I knew that most of the challenges we were facing had to do with one of the five focus areas, so after reading through the playbook and several other resources, I did some brainstorming to get my bearings.

I spent an hour or so writing down each question about the program that came to mind and added it as either a “people,” “process,” “goals,” “benchmarks,” or “budget” question. This system allowed me to visualize what needed to be worked through by categorizing and prioritizing each uncertainty.

Over the next week, I set up several meetings and sent dozens of emails to get to the bottom of my highest-priority questions.

Eventually, I was able to wrap my head around the proverbial “You Are Here” pinpoint on the map and was ready to move full-force into the launch phase, with the first step being strategizing, which is what we are going to focus on in this article.

Creating the Strategy: The First Step Towards a Successful Launch

Anyone who lives and breathes marketing knows the value of having clearly defined strategies for every channel, initiative, or campaign. Drafting this document is typically the first step when you have something that you want to implement because it gives you a starting point based on where you want to end up.

Inside our Outbound strategy, I addressed the following eight areas in detail:

- Objectives, Goals, and KPIs

- SD Metrics and KPIs

- Tools and Technology Stack

- Team Structure and Growth

- Campaign Parameters

- Campaign Execution

- Channels and Tactics

- Reporting

1. Objectives, Goals, and KPIs:

What we wanted to happen with the program, and how were we going to measure success.

For me, the main objective is to conceive, implement, and scale an effective Outbound team that generates pipeline and revenue for Hearst Bay Area.

Our goals are to:

- Create and launch the new Sales Development Strategy

- Align Inbound with Outbound to create Allbound

- Hire, Train, and Manage the SDR team of 3

- Have each SDR generating around 15 introductory meetings per month after their two month ramp-up period

And the primary KPIs are:

- # of Opportunities generated

- # of New Customers generated

- $$ Amount of Pipeline generated

- Revenue generated

2. SDR Metrics and KPIs:

The specific metrics associated with the Outbound team.

Aside from the overarching goals and KPIs, the Outbound team has its own set of metrics that they are accountable for to help us meet our goals. These include the specific activity metrics, quotas, and expectations for members of this team.

Our SDR team did not have defined activity expectations in the past, so I had to make an educated guess for what a reasonable number of activities and key outcomes (meetings) might be.

This will be different for every organization, but I used a loose calculation that considered our desired average deal size, historical opportunities generated rate, and historical closing rate for Outbound generated leads to come up with our quota.

Then, after researching what other similar companies are doing and considering the style of Outbound we would be performing (demand generation campaigns), I came up with a basic measure of how many daily activities should be expected of the team.

Since we don’t have any true benchmarks regarding SDR activity levels, these numbers are subject to change in the future after we have more data. As a starting point, I determined that the team should be averaging around 65 activities (phone calls and emails) per day, or around ~2,000 per month.

3. Tool Stack:

The tools we planned to use for Outbound.

Next, I had to audit our tool stack.

I outlined the tools that we already had contracts for and made sure we had something for each stage of the Outbound process (prospecting, enrichment, messaging, reporting).

Again, every stack will be unique to the business, but our tech stack is based around Salesforce, so almost everything we work with has the appropriate integration.

After speaking with several members of the sales team and doing demos of all the tools we already had contracts for, I shuffled some items around to come up with this as our starting tool stack:

- BuzzBoard – Prospecting + List Building + Inbound Lead Generation

- ZoomInfo – Prospecting + Enrichment

- MediaRadar – Prospecting + Enrichment

- LinkedIn Sales Navigator – Prospecting + Personal Branding + Outreach

- Salesforce – CRM + Task Management + Campaign Management

- Outreach.io – Outbound Messaging (Calls + Emails)

- Hubspot – Inbound lead management and nurturing

4. Team Structure and Growth Plan:

The SDR team lives within the greater marketing department and organization as a whole, and how many headcounts we’ve been allotted.

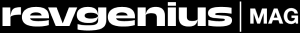

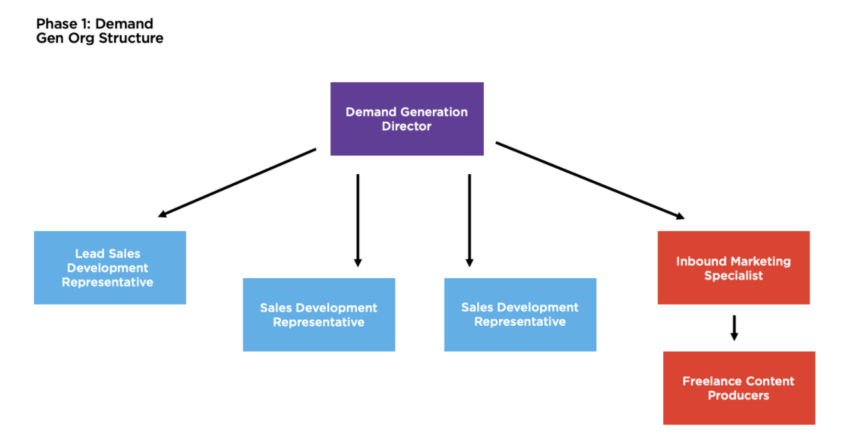

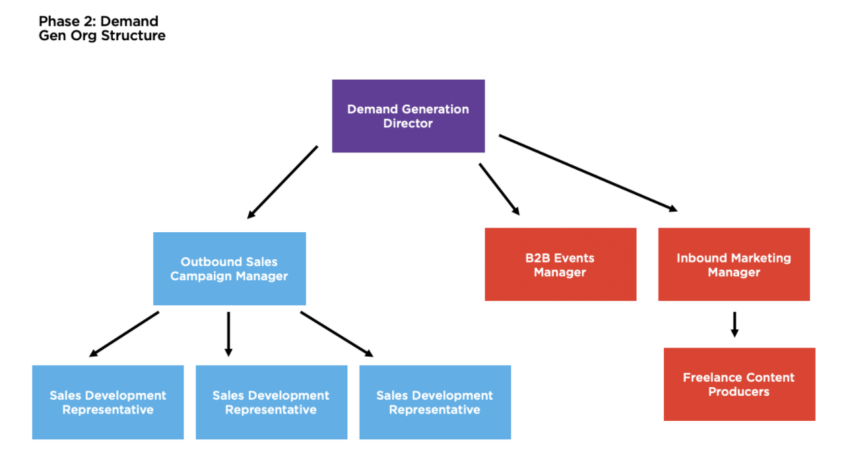

Inside the strategy, I included a departmental growth plan to shift and evolve as we scale. I mapped out three structures for each stage of growth, starting with the foundation that I’d been given and my ideas for where we would be in a year if things were to go exceedingly well.

Full disclosure: this is not how things have ended up playing out, but having the vision has helped keep me grounded as we continue to test and iterate on our strategies.

Phase 1: Building the Foundation (3 – 6 Months)

Phase 2: Scaling Out the Operation (6 Months – 1 Year)

Phase 3: Full Speed Ahead (1 Year – ?)

5. Campaign Parameters:

The best practices around how the Outbound team performs their work.

This is not only helpful for guiding the team members’ priorities and actions, but it is also valuable for the rest of the organization to understand so that they don’t make requests of the team that don’t align with our goals.

Average Deal Size

In my earlier research, I uncovered that the SDRs weren’t going after larger prospects.

They were being compensated more for meetings booked with Strategic Accounts, but getting access to decision-makers inside those organizations proved to be more difficult than at smaller companies, so the previous team did what was easy and booked as many meetings as possible with smaller brands to collect their commission.

Also, there weren’t any parameters in place around requesting SDR help. Sales teams would just say, “We’re trying to find an advertiser to buy into XYZ section – please go reach out to companies in X industry,” and that was how they were assigned work.

Without having clear strategies for prioritization or a communicated understanding of what the opportunity looked like, the Outbound team wasn’t being utilized effectively.

This was leading to a lot of unqualified meetings with low to no budget prospects. Those who did end up closing were for much smaller deal sizes than required to keep the program afloat.

As a result, I decided that this team would only do campaigns where the average deal size would be three times larger than what was being generated before.

Cadence

Another parameter that was added to the strategy was concerning how often we will launch new campaigns.

A typical demand generation campaign should start with a discussion around goals, customer profiles, and content. There is a lot of upfront strategic planning that comes into play before a campaign is launched, so the trick is to stagger the campaigns so that at any given moment, each team member is working on two or three simultaneously.

This new cadence parameter was put in place to ensure that no member of the department has too much or too little on their plate at any given time.

Qualification

The final parameter was that our sales organization is too large for a team of three SDRs to service entirely.

What we decided to do was only allow leads from the department (Inbound or Outbound) to go to “qualified” AEs (AEs who met at least 90% of their quota in the previous period).

That way, only the best reps for that period would be handed leads and given the opportunity to close them. We knew this would narrow down the pool of potential AEs, which would help streamline some of our team’s processes and access those who have the highest chance of closing the deal.

6. Campaign Execution:

A description of each phase of the demand generation process and areas of responsibility for each specific team.

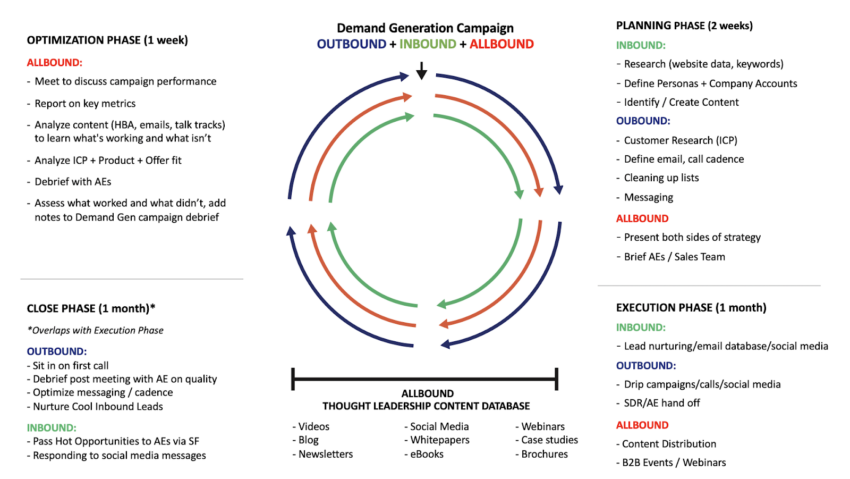

A fully functional demand generation campaign can be divided into four distinct phases:

- Planning

- Execution

- Closing

- Optimization

The image above represents our shift to Allbound, essentially the tasks and activities that overlap between our Inbound and Outbound teams.

Planning:

This phase is where the upfront research and strategizing occurs. As a team, we discuss the types of content we already have and what we might need to create, the campaign’s ideal customer profile, the offer, messaging, potential target accounts, goals for the campaign, and outreach cadence.

Once we have an idea of what our plan of attack is, we loop in the sales managers and AEs we will be working with to get their feedback on the strategies, agree upon the hand-off process, what the qualifications are for acceptance, and any additional rules of engagement that may need to be ironed out.

When everyone is in alignment, we get to work creating the necessary assets, pulling together our prospect lists, and scoping out any strategies (like hosting a virtual event or launching a paid ad campaign, for instance) that we plan to use. Once the plan is complete and we have all of our content, we move into the execution phase.

Execution:

During execution, the Outbound team is responsible for implementing whatever cadence of activities we define in the campaign strategy, as it does vary from one campaign to the next.

The team is expected to practice their call scripts and voicemail scripts, identify and report on objections they run into, log their metrics, and work together to optimize their messaging based on their responses during this phase.

As the work they do begins to generate interest from prospects, the Close Phase will enact, in which SDRs work closely with AEs to attend meetings, listen to feedback, and home in on the nuances between good meetings and poor ones while at the same time continuing the outreach and generating new introductory meetings for the AEs.

Closing:

After the prospect lists are worked for a few weeks, the SDRs continue working with AEs on potential opportunities from the pipeline they sourced.

Optimization:

And finally, we have the optimization phase where the department meets to go over all actions taken, which tactics had the best results, and where the biggest areas for optimization are in terms of ICP, product, messaging, cadence, content, and offer.

7. Channels and Tactics

Instructions for how the SDR team can use certain channels and tactics to their advantage.

I expect everyone on my team to use all of the information at their disposal to identify high-quality targets for outreach. This includes monitoring social media channels and participating in public conversations as representatives of the Hearst Bay Area brand.

As such, they are encouraged to be active on channels like LinkedIn and Facebook Groups and maintain a high standard of quality for their personal brands.

Building authority by creating and sharing thought leadership content, participating in round-up posts for external publications, actively joining in on industry-related conversations, and networking virtually and eventually, in-person are all ways to support our overarching domain expertise goals.

Some of the specific channels and their tactics we have outlined in our strategy document include:

- Facebook and LinkedIn Groups

- Marketing and Business Slack Channels

- Quora

Events

While in the current climate, live events are out – but there are plenty of virtual events happening every minute of every day. These are great places to not only learn but also identify potential prospects and accounts and start conversations.

Participating in the chat, offering advice, sharing relevant content to get people back to our website – these activities will ultimately help us saturate the market and help us become known as experts in our field.

Once live events begin again, our SDR team will be boots on the ground advocates for Hearst Bay Area and be empowered to network and engage with leaders in and outside of our industry.

Co-Marketing and Strategic Partnerships

Another channel for building authority, growing brand awareness, and generating leads is through strategic partnerships.

As front-line team members, our SDR team is encouraged to be on the lookout for opportunities to partner with other brands that are targeting the same audience with complementary products or services.

We use strategic partners to:

- Create co-branded content,

- Promote each other’s offers

- Run a co-branded event

- Create a referral system and share leads

8. Reporting

The depth and frequency of our reporting.

Of course, a strategy can’t be complete without an outline of how metrics will be reported and how often.

Including these details sets the stage for accountability and allows everyone outside of the department some insight into how you plan to measure and report success.

Creating the Strategy: Final Thoughts

I began working on this document on my literal first day as Demand Generation Director. It took me about a week to compile everything into a completed (yet fluid) strategy.

During the strategy build, certain stakeholders from outside my department put pressure on me to put my new team to work before I felt that we were ready. To protect our team from outside interference, I had to tap into the influence of my program’s champions to hold back the distractors.

I stood my ground because I was confident that investing upfront in the strategy would show a greater return than any desperate attempt I could make to please those who were impatient for results.

And despite having to push back on those outside of my department who didn’t quite understand the significance of the changes I was planning to implement, it is probably as clear to you now as it was to me once the document was complete that the department had already come a long way just from original conception through to the plan of action.

As I moved toward the next phase of the launch, I felt a lot more comfortable having the strategy to reference when making key decisions about recruiting, process creation, campaign prioritization, and execution, which we’ll discuss next time.

Some key takeaways from this post to keep in mind:

- Having a strategy is a necessity, not a “nice-to-have.” It is paramount to put your thoughts on paper to explain what you are doing, why you are doing it, and hold everyone involved accountable.

- Get your bearings early. Before you can determine which direction to go, you need to know where you are. Use the information you have access to as a compass to guide your strategic decisions.

- Communicate your goals clearly to the stakeholders of your department. This allows for transparency and helps set boundaries so that you can focus on what matters most for your success.