146 Leaders Share 8 B2B Marketing Mistakes That Rob You of Revenue

When it comes to marketing, B2B executives want results. They want a predictable pipeline with qualified sales opportunities that convert into high-value deals.

But more often than not, B2B marketing seems like a lot of effort for little results.

A process that generates awareness, but no leads. Or generates leads that don’t convert into deals.

Why is that?

We reached out to founders, CEOs, marketing and sales leaders from B2B Tech and B2B service companies.

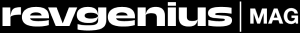

We discovered four big challenges and eight underlying mistakes that rob B2B companies of revenue:

The worst thing about these mistakes is that they act as “ROI taxes.”

Why taxes?

Because until the underlying mistakes are fixed, every campaign you run, every sales call you make and a proposal you send — will keep underperforming.

You’ll have to fight extra hard for every deal. You’ll need your team to go “all hands on deck” and squeeze all the juice out of your network to generate some opportunities. You’ll keep trying lots of ‘experiments,’ but none will clearly and repeatedly lead to a sale.

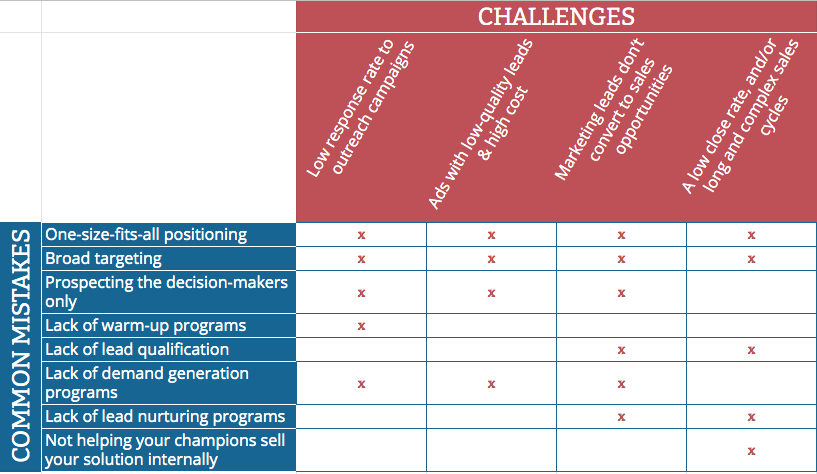

Challenge #1: Low response rate to outreach campaigns (55%)

It has never been easier to mass-email or send a LinkedIn message to your target prospects. Yet, it has never been harder to get them to respond.

In our research, this came out as the highest-rated challenge (55% of respondents identified with it). Here’s what they had to say:

“Low response rates to our marketing outreach”

“There’s so much noise on LinkedIn and email now”

“Getting any kind of attention amidst the flood of COVID-driven desperate marketing attempts by everybody”

“Our AEs, in tandem with the BDR team, are now doing full cycle in an attempt to fill their pipeline”

Our research indicated that there are eight common mistakes that are the root-cause of this challenge.

Mistake #1: One-size-fits-all positioning

Buyers are now more critical than ever. If it was hard to stand out before, it’s even harder to cut through the noise of “desperate marketing attempts by everybody.”

In this new world, generic positioning just doesn’t cut it.

Example. Take the two cold emailing products below. What’s the difference between them? Would you give either a time of your day?

The cold emailing tools market is, without a doubt, a bloody red ocean. To make things worse, the market was decimated by GDPR back in 2018.

And yet, playing in the same market, lemlist grew from 0 to $1m ARR in less than 2 years — without external funding (during the years just following GDPR).

How? They went all-in on unique personalization features.

But going beyond one-size-fits-all in cold outreach doesn’t stop with unique positioning and a strong value proposition.

To make outreach successful, it pays off to further personalize the value proposition and the messages for the specific segments and roles. More on this in Mistake #2 and #3.

Mistake #2: Broad targeting (conflicting responses)

In its most basic form, this mistake boils down to reaching out to anyone who could be a user of your product — which by now most people realize just adds to the noise. But if we look at the results of the research, this mistake appears to be more subtle:

While 77% of respondents felt they’re “very clear about what our most profitable segments are, and that they narrowly target their marketing to these niches,” 60% shared they didn’t have different campaigns for the different account tiers and 47% said they don’t regularly run in-depth interviews with their best customers from their target segments.

It seems that we have a different view of what narrow targeting means.

Solution: narrow targeting

Here is what I mean by narrow targeting:

- Building detailed Ideal Customer Profiles for each of your most profitable market segments, by running in-depth interviews of your best customers. You don’t really have an ICP if you produce a generic version for all segments — or if you base it on your biased interpretation. You need up-to-date (post COVID) data from in-depth interviews with your best customers from the target segment

- Segmenting your accounts into tiers based on revenue potential, and planning different lead generation programs accordingly to the revenue potential: e.g.

1-1 highly personalized manual campaigns for Tier 1; job role- and industry-personalized campaigns including manual warm-up and phone follow-ups and automated email and LinkedIn follow-ups for Tier 2; inbound marketing, paid ads and outreach based on engagement triggers and unique value proposition for Tier 3

- Not just targeting based on search criteria, but creating a dream list of companies you want to see as the clients from Tier 1 and Tier 2

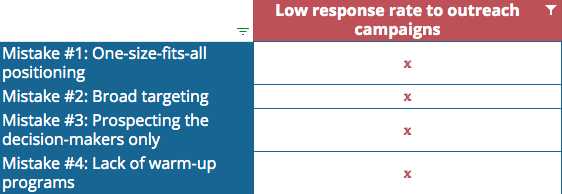

What can you expect from such an approach? In one of the most detailed, hands-on case studies I’ve read recently, Andrei Zinkevich describes a campaign that targeted only 30 accounts, and generated 37% response rate, and 20% contact-to-opportunity rate totaling $300K.

Mistake #3: Prospecting the decision-makers only

According to Harvard Business Review, the number of people involved in B2B solutions purchases has climbed from an average of 5.4 to 6.8 back in 2017.

What we’ve been hearing in our interviews is that the buyers now take longer to decide, and involve even more people than before.

To make matters worse, with so many of their colleagues working from home, opportunities for informal water-cooler conversations are few and far between, while the dreaded Zoom meetings further slow-down the process.

Solution: Prospect all members of the buying committee (using a specific value proposition)

Buyers now rely more than ever on digital information to support their decision-making process. By connecting to different members of the buying committee, you’ll generate more conversations.

More importantly, these conversations will allow you to gain a deeper understanding of the needs and objections of each buying committee member, so you can address each of them with a specific value proposition tailored to their job role, their needs and objections.

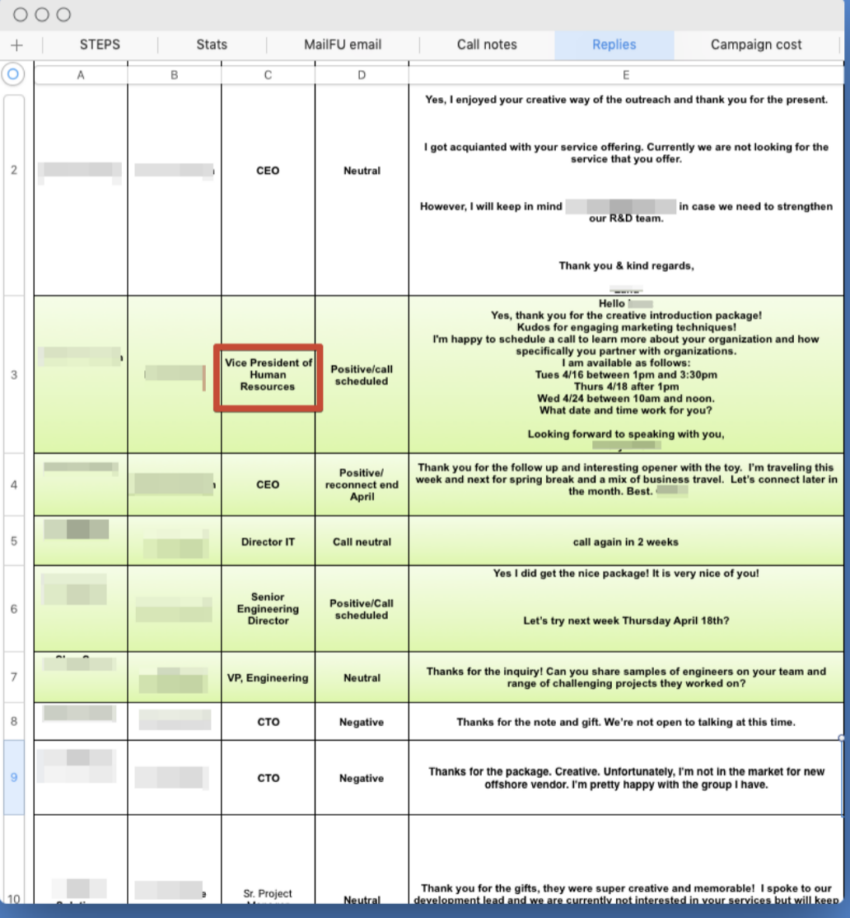

You cannot address the different roles with the same value proposition. What makes sense for the CEO doesn’t usually make sense for say, HR execs. In the case-study mentioned previously, you can read how the opportunities were generated through different buying committee members:

Mistake #4: Lack of warm-up programs

People buy from people they know, like and trust.

Most people accept this. And yet, most outreach is done cold, without previously engaging and building relationships with the members of the buying committee.

There is value in warming your prospects up before reaching out to them.

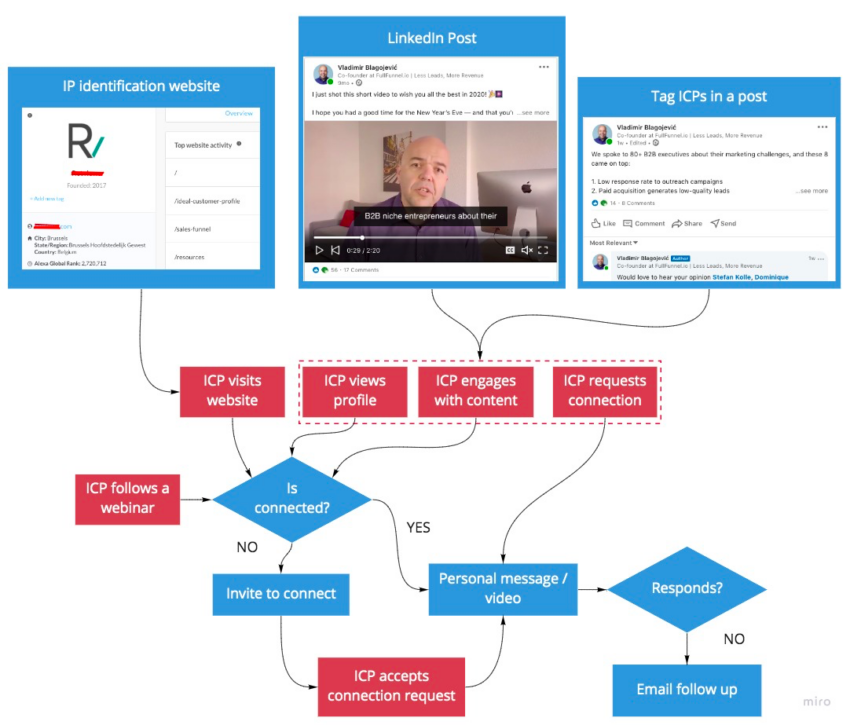

Solution: Build on Inbound engagement with ‘Allbound’ marketing

People tend to fall into one of the two categories: the first one swears by outbound outreach, while the second is all about inbound marketing.

I believe they’re both missing out on opportunities big time.

Why not combine both for maximum results?

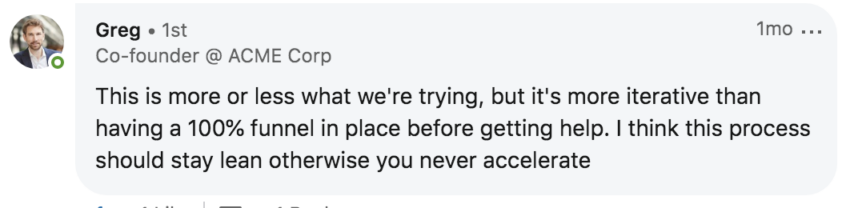

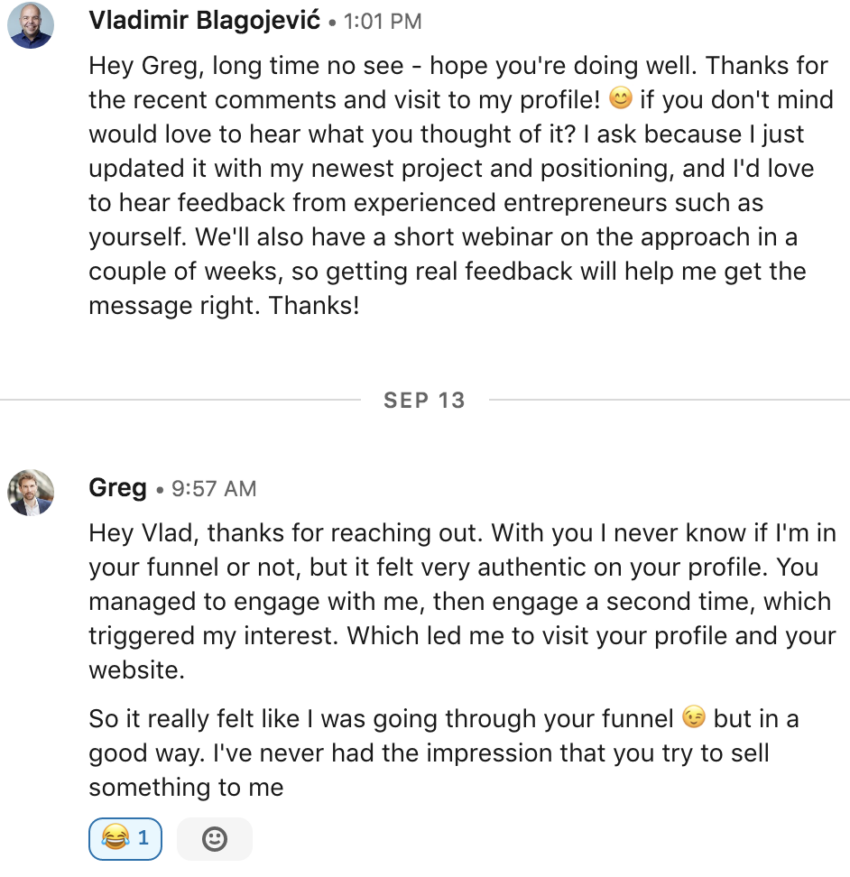

Example: building on LinkedIn post engagement. An ICP commented on my LinkedIn post (names changed to protect his privacy):

His comment was spot on and is actually a common sales objection we get, so I created another LinkedIn post and mentioned him in the comment:

In the meantime, Greg also visited my profile, and I initiated a chat with him via PM:

Great to connect, but the conversation fizzled out. You’ll see below how I managed to pick it up again — but I first want to share more examples.

Example: elevate your teammates. What worked for us is to be active on LinkedIn with multiple profiles, and mention each other in our posts. For example, in the post from above, I thanked my co-founder Andrei for “teaching me the art of marketing audits” — and as a result, someone reached out to him asking him if he could teach him “the art” too.

Or, in the example below, an ICP (names changed to protect his privacy) liked a post from a colleague that mentioned me, and as a result visited my profile, and invited me to connect. I accepted the connection request and recorded a short Loom video, sharing my thoughts about his business and pointing him to a case study.

The initial interaction stopped, but he later joined a webinar we were hosting, received a post-webinar nurture sequence and booked a discovery call in my calendar.

Example: after engaging members of the buying committee, connect to the decision makers.

After receiving no response, I followed up via email, because let’s be honest, LinkedIn Inbox sucks. That conversation lead to a discovery call:

Solution: Make them look good

Sometimes your message may miss a mark, your conversation may fizzle out without leading into a call, or your contact will remain unresponsive.

If so, then it’s time to change the approach.

Example: Invite decision makers to an interview (e.g. for a podcast).

Now, it’s important to realize that the podcast interview is NOT a sales call. But it’s a great opportunity to build a 1-1 relationship with your top-tier decision makers and learn about their goals and challenges.

This allows you to qualify them, and personalize your pitch to the specific challenges they shared during the interview (or in a short conversation you’ll have following the interview). You might ask:

“during the interview, you mentioned that you guys are struggling with X. We recently worked with a company in a similar situation and helped them achieve Y. I’d be happy to tell you more on another call if you’re interested”

OR: “As you already know we <specific value=”” prop=””>. Do you know companies who would be a good fit?”</specific>

You also get three opportunities to follow up:

- Right after the call to thank them for the interview

- When the podcast is published

- Once more to thank them for their contribution with a LinkedIn recommendation and potentially with a small, personalized gift

Example: Invite members of the buying committee to contribute to an article you’re writing.

Remember the example above where the conversation with “Greg” fizzled out? I reached out to him when writing this article, and he asked for a call. Again, this is not a sales call, but a great opportunity to learn about my prospect’s goals and challenges. Note that this was not likely to happen had there not been multiple touches preceding this ask.

In fact, while writing this article I reached out to a few more people, and here are the stats of that campaign:

Solution: Mix up the channels and approaches

A mistake that I often see is that people either give up after a first unsuccessful trial to get a response — or keep sending reminders using the same basic offer and channel (‘hey just a quick reminder about my previous email…’ 👎).

What I found works better is to mix things up.

Note that in most of the examples above there were multiple touches — and often multiple channels — before the meeting was on the books.

Just look at this example: engagement with a post → conversation in the comments → a sign-up to a webinar → a conversation with my colleague through email → a personal video message as a follow up after the webinar → an invitation for an interview via WhatsApp → a follow up through email (which ended up in a call):

Note too, that while most of the touches were initiated by me, none of them was a blatant “do you have 15 minutes on Thursday to chat about how we can help {company}”. That wouldn’t make sense because they don’t know, like or trust you. And, you don’t know them, their challenges, nor their buying stage.

Instead, with every step, you’re offering to take the relationship to the next level — while leaving them in control. These are smart, experienced people — if they are looking and like what you do, they’ll ask.

Challenge #2: Paid acquisition generates low-quality leads (41%)

41% of respondents marked this as their challenge:

LinkedIn advertising to reach new buyers: conversion rates and click-through rates are quite low here

Leads that come in aren’t qualified and the quality can be very arbitrary. It’s difficult to figure out if it’s worth having a first phone call or not.

I find that most of the leads that are generated are not with the actual end user, champion, or final decision maker.

Most of the mistakes causing low response to outreach campaigns previously mentioned are valid here too — but probably the biggest one is the lack of warm-up programs.

In his talk on Full Funnel B2B summit, Dennis Yu, an advertising expert, spoke about the biggest mistakes B2B companies make when running ads. The number one mistake, according to Yu, is sending cold traffic to a lead generation campaign.

I call this “the naive B2B funnel”.

It’s basically offering people who don’t know, like and trust you a discovery call or a demo.

You haven’t yet shown your value. You haven’t built up any rapport. You haven’t given them a chance to decide if they even want to continue this relationship before you dive right in.

Equally important, you don’t know them. Are they a fit for your solution? Have they identified a problem yet or are they just looking for some useful tips to do their job better?

The result?

Low conversion rates and a high cost of acquisition.

According to Dennis Yu, the best-performing campaigns spend up to two thirds of their marketing budget on the warm-up part of the campaign.

Challenge #3: Marketing leads don’t convert to sales opportunities (41%)

The two most common forms of this challenge:

- Prospects sign up for a call/free trial/webinar/event and don’t show up, or go cold afterwardsThere have been umpteen instances when people would ping us on Intercom, set up a time slot to speak, and wouldn’t turn up. It was quite frustrating, but I guess it is part of the game.

- Prospects join the call with no intention (or authority) to buyWe would typically end up with the wrong contact person, the one that is interested to find out all what is new in his sector, but not responsible for deciding or without a budget.

It’s difficult to discern ‘interest’ and basically being inquisitive from ‘genuine interest’ and ‘this pertains to an actual problem of mine’.

I would say the “spinning tires” on leads that aren’t in your ICP is a big one and these points above touch on why that happens! Spending too much time for little return!

Mistake #5: Lack of lead qualification

For a lead to be qualified, two conditions must be met.

Condition #1: they have to fit your Ideal Customer Profile (ICP). In its most basic form, you need to make sure you have the right person from the right type of company in front of you. But it would be too simplistic to chuck the “bad fit” solely to lack of a proper lead qualification form.

For example, the misfit could be due to one-size-fits-all positioning or broad targeting (the mistakes #1 and #2 we discussed previously).

Here is a concrete example. I was chatting with an exec from a sales training company who wanted to book a call with me. I checked their website and saw the top industry they work with is professional services — thinking cool, these guys understand how our niche is different. So I asked the exec what made his company stand out in the professional service space. He said:

“I support companies by understanding skill-sets, staffing, structure, and strategy and where they may need to make changes to meet their goals. I work in a variety of industries, but our methodology is industry agnostic”.

What a missed opportunity! There is just so much to be said about sales in professional services, there have been whole books written about it!

Or let’s take the “Mistake #3: Prospecting the decision-makers only.” You may be in contact with a person with no budget or authority to decide — but this can be a great opportunity to build intelligence about your account, learn about their needs and who you need to talk to. Now that you know how, nothing prevents you from reaching out to the rest of the buying committee as previously described.

Condition #2: they have to be sales-ready. Up to 97% of your leads are not sales ready (see Mistake #6). When I discuss this with B2B execs, their first question is:

“So how do we target those companies that are sales ready?”

The truth is that in most cases it’s almost impossible to detect if a prospect is buying without speaking to them. Which creates a “chicken or the egg” problem: how do you get them to speak to you if they are not sales-ready?

That’s why I love the “make them look good” approach I discussed under Mistake #4. Not only do you get to speak to more people, but you also get to qualify and see if they are sales-ready by asking the right questions.

Even if you could somehow infer if your lead is sales-ready before reaching out — by contacting a sales-ready prospect, you are likely already too late to the party. Especially if your competitors were there during your prospect’s discovery journey, framing their problems and educating them about requirements in a way that positioned their solution as a natural choice.

Mistake #6: Lack of demand generation programs

According to late Chet Holmes, the author of the Ultimate Sales Machine, only 3% of your target market is actively buying right now.

Pitching your product or showing a demo to someone who’s still trying to understand their problem makes no sense. That’s the main reason why the “naive B2B funnel” gives such poor results.

Companies who understand this augment their lead generation with demand generation activities:

- Educate target verticals helping them to identify business challenges and bottlenecks

- Connect to and building relationships with the different members of the buying committee in target accounts

- Drive awareness and PR for their company and executives

- Develop lead nurturing programs

- Launch co-marketing and partnership programs

Mistake #7 Lack of lead nurturing programs

When you’re generating leads that aren’t sales-ready yet, they are not likely to book a call with you. And even if they do, there is nothing you can say or do during the call that will help you close the deal — because there is no deal to be closed (read: they are not buying).

This is where lead nurturing comes into play:

Companies that excel at lead-nurturing generate 50% more sales-ready leads at a 33% lower cost. (Invespcro)

Nurtured leads make 47% larger purchases than non-nurtured leads. (Invespcro)

How does lead nurturing work?

It turns out, quite similar to the Chinese prison approach.

In his legendary book, Influence: the Psychology of Persuasion, Cialdini tries to answer the difficult question: how did the Chines get their captive American soldiers to collaborate with them without resorting to torture? After all, these were men who were trained to provide nothing but name, rank, and serial number.

The Chinese answer was elementary: start small and build.

For instance, prisoners were frequently asked to make statements so mildly anti-American or pro-communist as to seem inconsequential (“The United States is not perfect.” “In a communist country, unemployment is not a problem.”).

But once these minor requests were complied, the men found themselves pushed to submit to related yet more substantive requests:

- A man who has just agreed with his Chinese interrogator that the United States is not perfect might then be asked to indicate some ways in which he thought this was the case

- Then, he might be asked to make a list of these “problems with America” and to sign his name to it. Later he might be asked to read his list in a discussion group with other prisoners.

And so on. What amazing is that overtime, the man would change his image of himself to be consistent with the deed and with the new “collaborator” label, often resulting in even more extensive acts of collaboration.

This excerpt demonstrates clearly how the consistency and follow-ups with your previous actions can lead to incredible results.

Lead nurturing is similar.

With every email (or any other communication channel) we should “sell” small ideas, not our product. We should overcome objections and doubts, we should demonstrate the benefits of our product.

We should provoke and let our leads think about our products the way we want.

How do you start with lead nurturing if you don’t have anything in place?

- List all the questions and objections the different members of your buying committee have during the sales process

- Set up a lead nurturing program at the bottom of the funnel (see Mistake #8)

- In the meantime, you can start writing short LinkedIn posts answering these questions and using them within your warm-up programs (see Mistake #4)

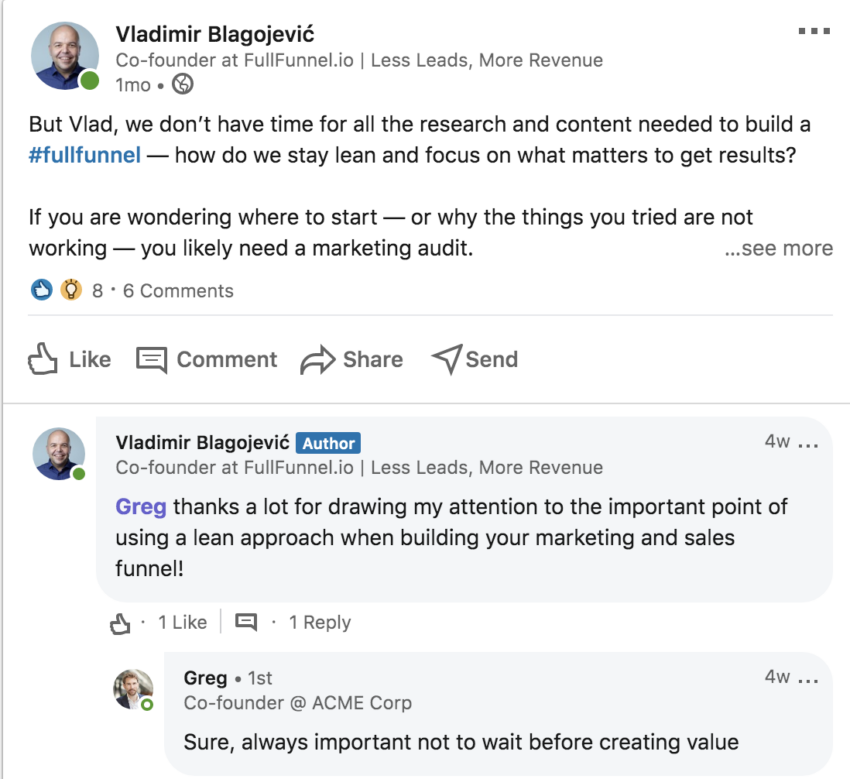

- Take your best performing posts and turn them into nurturing steps. For example, remember how Greg raised a critical question, to which I’ve written a LinkedIn post about? It ended up as one of the emails in our nurturing cadence:

Challenge #4: You have a low close rate, and long and complex sales cycles (46%)

We have sale cycles of more than a year, often longer than 2 years. We have tried to shorten them, but it doesn’t seem to work out.

Our market is dominated by a legacy player. It’s hard to get the prospects to see the value of our tech compared to the solution they already have

We need to provide discounts to close deals

Depending on your context, this challenge may appear differently.

Case #1: You’re operating in a well-established market with many competitive alternatives (e.g. CRM, customer support software, marketing consultants…). Prospects who are aware of the product you sell, will quickly box you in a category and “if they need you, they know where to find you.”

A core mistake in this market is one-size-fits-all positioning (see Mistake #1) and will make your marketing and sales an uphill battle. Two positioning strategies work well in this case.

A first one is the “Big fish, small pond” — by becoming a “<solution> for <vertical>” provider. For example, a client of mine developed a new survey tool that gave higher response rates and more relevant responses. Their technology was innovative, provided unique benefits, and they had a few corporate clients. But it remained a struggle to build traction in the ‘usual suspect’ markets, like employee engagement surveys.</vertical></solution>

After a veteran CEO joined their team, they decided to take a step back and review their existing customers. The most promising use-cases seemed to be in the healthcare market. While it was a long and difficult journey to enter first hospitals, and finally the large pharmaceutical companies, their average deal size grew by a factor of 10, while their competition was a fraction of what they faced before.

Another positioning strategy, “challenge the status quo,” works well in this case too. In the section about Mistake #1 above, I wrote about how this strategy helped lemlist grow from 0 to $1m ARR in less than 2 years without external funding — in a bloody red ocean of cold emailing tools, that was decimated by the GDPR regulation.

Case #2: You’re operating in an emerging category, of which most of your prospects are not aware of. The main problem here is that your prospects may not have a frame of reference.

When Drift was starting, most marketers were not using chatbots on their website. So the first thing that Drift did was to position against a solution marketers were aware of: lead generation forms. They used what Andy Raskin calls the “name the new game” narrative. Instead of merely attacking the problem (as most B2B brands do), they attacked the status quo, the “old game” (leadgen forms). You are effectively naming the reason your competitors are becoming obsolete AND introducing a sense of urgency. To survive in the newly emerging world, you say “what you’re doing today (and what the competitors offer) is not enough.” The winning companies play a new game, Drift called their new game “conversational marketing.”

Other than carefully thinking about positioning, there are two core mistakes that need to be addressed when going to market in an emerging category:

- Broad targeting (Mistake #2): the majority of the market won’t be ready for the new category. Your job is to find the early adopters, which will become your traction base. In case of Drift, these were product marketers

- Lack of demand generation (Mistake #6): since most of your prospects are not aware of your product category, you need to spend a lot of time educating your market and preparing sales-ready leads, or you’ll end up with people joining demos out of curiosity and with no intention to buy

Mistake #8: Not helping your champions sell your solution internally

Did you ever send a proposal or another document for your prospect to consider, only to be met by silence for days or weeks, while your follow-ups are being ignored?

It’s like your document has disappeared into a black hole.

Until one day you get a curt response: “sorry, it’s not the right time, but I’ll definitely get back to you when we’re ready” — or some other message that doesn’t tell you much.

What’s likely going on in the prospect’s organization is a number of internal discussions. They may be considering your proposal against other options. For example, imagine you’re selling an ABM (account-based marketing) solution, which the account’s CMO is championing. Your proposal may have been blocked by the unbelieving sales director, or IT may have raised issues about GDPR. You’ll never know.

That’s where a buyer enablement content at the BOFU (bottom of funnel) stage can help. Here is a simple process we follow:

- Gain a deep understanding of the needs and objections of the different members of the buying committee through interviews and research

- Develop buyer enablement documents and tools such as case studies, business cases or ROI calculators, product videos, competitor comparisons, documents answering critical questions and outlining the benefits for the different members of the buying committee etc

- For each account, create a dedicated content hub in a tool like DocSend, and upload relevant documents, personalizing the case studies and other material to your target account

- Tools like DocSend come with analytics showing you who has visited which of the documents, up to the individual pages they’ve spent the most time on. This allows you to do timely and relevant follow up. For example, if a prospect has spent time reading a page about ABM account orchestration, I could follow up saying something like “Just wanted to see what you thought about the case study I shared with you a couple of days ago. Many people have questions about campaign orchestration. If this is a topic that’s of interest to you, I’d be happy to dive deeper into details on a call.”

Final Thoughts

If you’re not getting enough results from your B2B marketing efforts, it’s likely that you’re missing critical elements in your marketing funnel.

A full-funnel B2B marketing approach that generates revenue, not just leads, needs to:

- TARGET: Focus on the 20% of your best clients who generate 80% of results, referrals and revenue. This includes crafting specific value proposition for your target segments, segmenting the accounts from each segment into TIERS and targeting them with different campaigns (e.g. 1-1 campaigns for top tier / tier-1 accounts and demand generation programs for the tier-2 customers)

- STAND OUT by aligning the unique benefits of your product with the specific needs of your ideal customers, and clearly communicating how you’re different from alternatives, in a way that matters to your target accounts

- ATTRACT your ideal clients even when they are not buying, by building demand generation and warm-up programs that help prospects get to know, like and trust you, so they are more likely to connect (and be aware of your unique value proposition)

- CONNECT to your best clients and build a relationship at scale — without mass outreach or reverting to manipulative tactics

- QUALIFY: Avoid wasting time on low-quality leads and make personalized offers aligning the benefits of your product with the needs and challenges of your prospects

- NURTURE: Shorten your sales cycles by making timely personalized follow-ups and arming your champions to sell your product inside their companies.

- EXPAND: Retain, expand and generate new business opportunities, while increasing LTV of each customer with a client success process.